Home Purchase Loans and Refinance in Louisiana

Welcome to the official site of THE LENDING SMITH MORTGAGE LLC. We are a full-service mortgage company based in Gonzales, LA. We specialize in Home Purchase Loans and Refinances throughout Louisiana. Whether you are buying a home or refinancing in Louisiana, we can help you realize your dream of homeownership or save you money when getting your new lower monthly payment. Want to build the home of your dreams? We have you covered with our One-time-Close Construction Loan that lets you go to Closing and move in once your home is completed.

In terms of Purchase Loan programs, we offer the following including VA loans:

FHA | USDA | HomePath | Conventional | Construction | NON-QM Loans

We offer a wide range of refinance options, designed to best meet the needs of local borrowers. If you're looking for cash out, or to just get a better rate and term, we can assist you. We offer the following Refinancing Programs:

FHA Streamline | FHA Cash Out | USDA Streamline | VA | Conventional

Our DSCR or Debt Services Coverage Ratio Loan allows borrowers to quallify based on the Property's Cash Flow, so no Individual Debt-to-Income Ratio calculation. First Time and Seasoned Investors can build thier Real Estate Portfolios with Multi-Unit properties. Properties can be Purchased as Individuals or Business Entities.

What makes THE LENDING SMITH MORTGAGE LLC unique is our great Customer Service and providing a variety of Loan Programs such as: One-time-Close Construction Loans, Investor Cash Flow Loans, and Down Payment Asssitance programs.

Contact THE LENDING SMITH MORTGAGE LLC today to discuss your mortgage loan options, and find out which loan program will best suit your needs.

Our App guides you through your mortgage financaing and connects you directly to your loan officer and realtor.

Learn what options refinancing makes available to you.

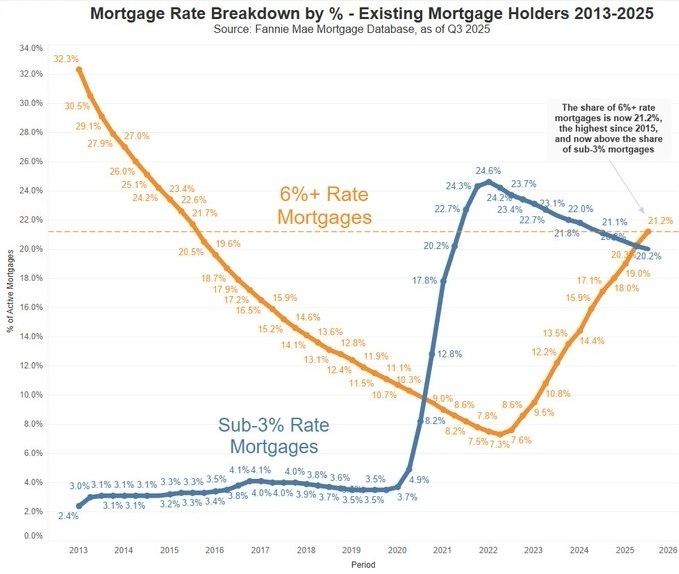

Find out what this rate drop means to you for buying a new home.

Find out what the experts are anticipating for 2026 housing